Scaling-Up: Crossing the Internal Chasm in Corporate Innovation by R-C Ohr

This article was co-written with Frank Mattes from Dual Innovation and innovation-3.

The race is on for companies to find big, explorative or even “disruptive” innovation ideas. ‘Disrupt yourself or someone else will’, it has been said. Almost every company shifts into overdrive to create ‘smart’ products, to turn a product business into a service business, to create new business models or to reach out beyond their traditional industry boundary.

This race is fueled by shareholder’s and business media’s demands to be ‘more innovative’ as well as by the Digital Transformation tsunami – which already has reshaped some familiar shorelines in several industries.

There is a huge noise around what companies should do to find the big ideas. Compared to it, the discussion about the best way of turning those ideas into substantial businesses is almost silent. We think it is high time to change this.

Vehicles used for the corporate innovation race

Huge sums of money are spent to build dedicated, vehicles to win the innovation race:

- Leading companies have invested heavily into more than 300 corporate innovation centers around the globe. Depending on the companies’ objectives, these innovation centers are mostly autonomous, designed as corporate accelerators, incubators, Digital Labs or in a blended form.

- ‘Hackathons’ or comparable formats are used to bring together external ideators with internal experts for drumming out disruptive ideas.

- There is a significant rise in investments into open approaches to innovation such as scouting, listening posts, corporate-university partnerships, technology spin-ins etc.

- And finally, as has been shown last year, Corporate Venture Capital is re-positioned from a primarily financial instrument towards a major innovation driver.

However, there are only few reports that ideas coming out from these approaches really moved the needle. Quite contrary, there is an increasing number of stories showing that prestigious companies, some of them world market leaders, have been shutting down their innovation centers.

So, what is going on here?

Facing the organization-internal chasm

Geoffrey Moore has pointed out 25 years ago that ‘out there’ is a chasm to be overcome in the market diffusion of non-incremental or disruptive innovations.

Increasingly, companies notice that there is also a organization-internal chasm when it comes to those innovations. They observe that the transfer rate from the promising ideas generated in the vehicles mentioned above into substantial business is too low. Depending on the specific company’s situation, one also hears

- ‘Our promising innovation concepts stumble or die along the way’

- ‘We have too many stakeholders with diverse and frequently changing intentions’

- ‘Our corporate start-ups can‘t find a sponsor or an organizational home to grow’

- ‘The time-to-impact is too long’

- ‘The desired business impact can‘t be reached’

The two-front war of corporate start-ups

In our view, to understand the chasm – and hence to increase the business impact from explorative ideas – it is key to recognize that corporate start-ups are fighting a two-front war.

Conventional start-ups are fighting on one front ‘only’: They want to win the market and scale their business. However, ‘corporate start-ups’ (in this context defined to be an explorative idea with validated product/market-fit which should be turned into significant business by leveraging corporate assets) are forced to fight additionally on a second, internal front.

This second front is the inherent tension between the core organization and the corporate start-up. The tension comes from the largely incompatible designs and operating models of these two organizations, which are based on two completely different rationales. It cannot be avoided – but it can be managed.

The business units of the core organization are operators and incremental innovators. They are designed to exploit the opportunities in defined markets, technologies and business models. They are based on lean / efficient and 0-mistakes principles. They are driven by solid, near-term financial goals. They excel at keeping supply chains and factories humming and at managing complex networks of suppliers, distributors and business partners.

The core business, however, is not designed to create risky leap-frog, explorative innovation that is incompatible with the existing business system at the outset.

Quite contrary, corporate start-ups has an explorative DNA. By definition, they’re designed to look further ahead and explore terrain that is not yet on the corporate map. They are based on agile / lean start-up / test-and-learn principles. They are geared towards long-term (financial) goals. They excel at finding new ecosystem / co-innovation partners and push the innovation agenda into new business models and sometimes even beyond the defined industry boundary.

Why we need Scaling-Up: The process view

For many companies, transitioning a particular corporate start-up over the chasm, i.e. scaling-up the big idea, is still an art, not a practice. The rare success cases can mostly be ascribed to ideal ad-hoc conditions or to corporate mavericks burning for their ideas so much that they were willing to fight all the conflicts and risk their own career in doing so.

Working with our clients on solving the Scale-Up-problem, we found it helpful to divide the process from ‘insights’ to ‘significant business impact’ into three different stages:

- Start-up: Discovery / Ideation / Incubation

- Scale-up

- Growth

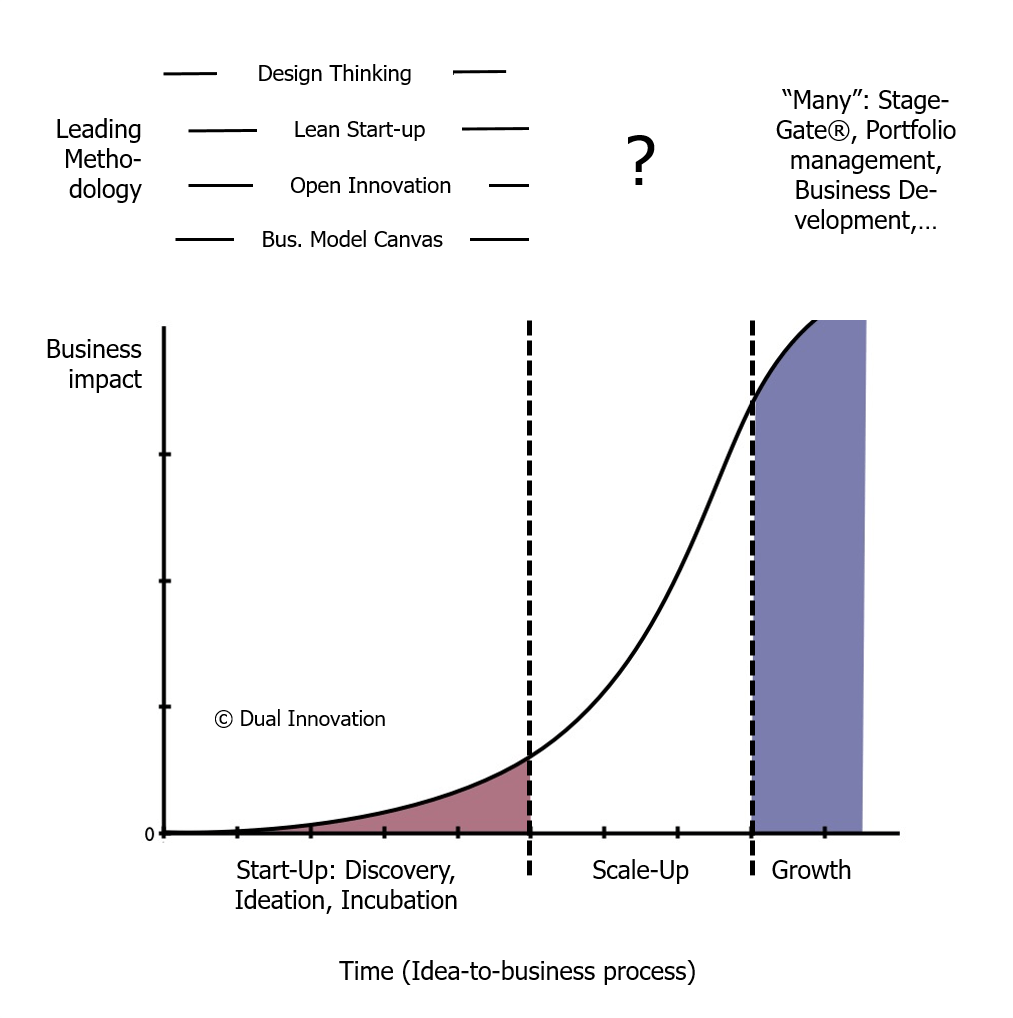

Exhibit 1: Scaling-Up in process view

After making this distinction it becomes apparent that from a process view the transition between ‘having a validated idea’ and ‘driving business growth from inside the core organization’ is underexposed today (see exhibit 1).

In the Start-Up phase, we find a solid body of knowledge on how to work effectively:

- Design Thinking helps to understand the unmet / under-served but valuable customer needs and to come up with meaningful ideas, including how these ideas should be validated

- Lean Start-Up and customer development helps to understand how to turn these ideas into a business context, including how to build minimum viable offerings, create and develop initial customers and leverage agile iterations.

- Open Innovation helps to understand how to look for external, missing pieces of technology, capability and knowledge, including how these should be integrated

- Business Model Canvas helps to set a joint language for discussing “mechanics” of novel businesses and key aspects in defining the business model to generate profits from the ideas

At the other end of the spectrum we find many – too many to mention – methods helping companies to grow an existing revenue base once a solid initial customer base has been established.

However, compared to these two phases, there is no comparable body of knowledge for the Scaling-Up phase. This essential transition looks a bit like innovation’s ‘no-man’s land’.

Why we need Scaling-Up: The portfolio view

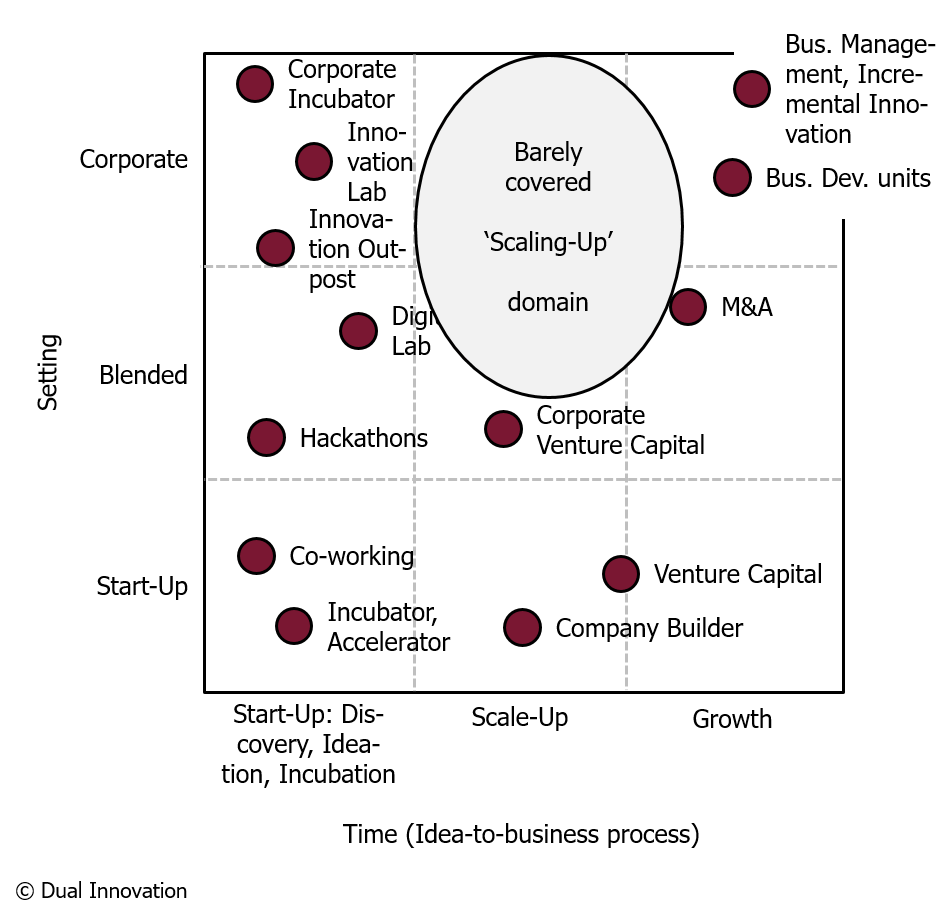

There is a second lens that underlines the need for developing a solid Scaling-up-methodology. If one plots the vehicles companies use to win the innovation race (see above) in a portfolio showing the phases and the set-up, one finds that there is a big, open space (see exhibit 2).

Exhibit 2: Scaling-Up in portfolio view

Most of the vehicles used to win the innovation race are focused on the stages Discovery, Ideation and Incubation. Depending on the specific company goals, they are set up in a start-up-setting, in a corporate setting or in a blended form. Our research did not find formally set-up vehicles for Scaling-Up. There are some companies discussing with us how to set up dedicated units for scaling-up – but these are not operative yet.

For us and for many companies it becomes apparent that there is a missing piece in corporate innovation and digitization. The pivotal area, which features a unique focus on combining scaling-up (vs. ideation/discovery or incubation) of corporate start-ups with corporate (vs. start-up) setting has not been addressed by companies adequately up so far.

Scaling-Up will be one key component of modern Dual Innovation

We expect that there will be a growing focus on a ‘Dual Innovation Management’ that integrates sustaining or incremental with explorative innovation and provides a solid basis for corporate start-ups to scale and become a meaningful business.

From discussions with leading companies (see below), we anticipate that this Dual Innovation Management will

- integrate core innovation and explorative innovation strategy as dual and highly incompatible directions of impact

- properly govern the critical resource allocation process among both directions

- adequately manage the vital “interface” between the two camps, particularly involving a defined Scaling-Up approach

- be operatively covered via a portfolio management process, comprising distinct types of innovation activities across three playing fields (Optimize the Core, Reshape the Core, Create the New)

- involve senior leadership to play a critical role in leading and managing all playing fields

- have access to mitigation mechanisms to balance the inherent conflicts between corporate start-up and the core organization

- will work with corporate organizations that are prepared to absorb explorative innovation

Leading companies are working on Scaling-Up

We found that several companies see the issue that we addressed in this article and aim to be leading in ‘turning Scaling-Up from an art to a practice’. We suggested a process that would produce a framework which allows for navigating in the pivotal point.

More than 30 companies were interested in exploring ‘Next Practices’ and to develop a methodological framework. These companies come from different industries which makes it clear that the scaling-up-problem is not industry-specific and promises also exciting discussions:

- Electronics / HealthTech

- Telecommunication

- Medical

- Automotive

- Financial Services

- Technical Services

- Construction

- Cosmetics

- Project development and construction

- Lighting

- Oil & Additives

- Oil and Energy

- Materials

- Metals

- Life Sciences

- Chemicals

Work in this Peer Group will start in the next few weeks. If you would like to join this group of fine companies, please drop me a line.